CTA Advisory Services

- Portfolio Construction Services

- Providing Internal Signals

- Sourcing External Programs

- Executing Trading Strategies

- FX Brokerage Advisory

- Analytical Research

Since 1999 we have been providing CTA advisory services to both investment professionals and institutions. As a result of our success we managed over $100M in client assets, with advisory assets exceeding $500M. Our CTA signal strategies have been acknowledged from the industry with awards from; HedgeWeek, HFM, EuroHedge, Nordic Hedge and Investors Choice.

Our trading signals are developed from a methodology that is engineered to contribute towards improving overall portfolio diversification. Furthermore, we aim to achieve this without significantly lowering return expectations or increasing risk.

Mikkel Thorup – Strategy Specialist

I am a progressive investment professional with a blend of experience in working with top tier level banks. This experience was vital when managing the investment aspects of an independent CTA firm. Therefore, throughout my career as an investment advisor I have developed a consistent track record of risk adjusted returns. I achieved this by drawing upon my skills and expertise in managing and trading both currency and interest rate risk.

With over 20 years experience trading the financial markets, I have developed the skill to create CTA trading strategies for the sophisticated investors. I actively manage alpha driven strategies, as well as a number of other hedging programs and signal generating strategies. Furthermore, I provide fundamental currency analysis to external investment funds on an advisory basis. Hence, these funds utilise my views to evaluated each strategy using technical analysis.

Mike Rasmussen – Operational Specialist

For more than 15 years I have developed my career within the financial services industry. Learning from the ground up to build a CTA firm with product offerings tailored towards institutional and HNWI clients. From my role as Chief Operating Officer dedicated to managing over USD 100M in trading assets, my responsibilities covered many duties. To summarise these included; company administration and compliance, trade reconciliation and product marketing.

Throughout my professional career I have managed numerous assignments which require cooperating with multiple individuals and professional relationships. This has given me the skills and experience in managing and communicating with others on projects that require updates and completion to specific deadlines. I am organized and task orientated, with the ability to develop new ideas as well as taking the initiative. I have a graduate degree in Business Studies with a major in Economics and Forecasting.

An Alpha Generating CTA Strategy

To generate the sought after performance gains, our CTA advisory services meet two basic needs. Firstly, by investing in a CTA strategy you can increase the yield of short- to medium-term positions. Secondly, we can create a hedge for currency exposures which arisen from purchasing for example, foreign stocks.

Adding a CTA strategy investment to your portfolio

increases its diversification. Consequently, risk may

decrease due to low correlation with the stock markets.

Utilising our CTA Advisory Services

- Idea Generation

- Investment Approach

- Trade Execution

- Diversification Factor

- Relative Performance

- Risk Contribution

Individual investment portfolios are constructed after the specific needs of our clients. Therefore, as a ‘best-of-breed’ CTA recognised by HedgeWeek, we use our skills to construct portfolios that are designed to efficiently shift assets between strategies. Most of all we seek to optimise returns by selecting strategy signals that perform stronger in current market conditions. Consequently, we aim to achieve this without significantly lowering return expectations.

Active Investment Strategies:

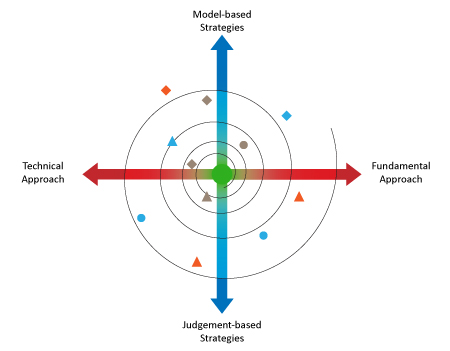

When constructing a portfolio the first stage of the investment advisory process is to identify each trading strategy. Following this process, our analysis characterises the method of strategy execution. As a result, the selected core strategies display the abilities to generate stable risk adjusted returns under various market conditions. In addition to this, the investment advisory process seeks satellite strategies as alpha seeking contributors using a controlled level of risk.

Absolute Return Investing:

Designed to achieve positive results, our CTA trading signals are absolute return strategies. These types of investment signals are concerned with the return of a strategy, and not a benchmark comparison. Furthermore, the methodology is designed to achieve these targets with less volatility than traditional strategies. A broad portfolio can be diversified with our CTA signals thereby improving the risk/reward return stream over the long term.

Sourcing External Managers

To be able to build successful investment strategies, we strive to access only a clearly defined CTA Strategy. In this regard the manager selection procedure is one of the most important aspects of our process for seeking alpha. To aid this process a key criteria of our analysis is to focus on the correlation between each strategy and global equity indices. Furthermore, we assess how each strategy functions under various market conditions.

The selection of each external manager is on the basis of a variety of quantitative and qualitative criteria, including;

- Long-term positive returns on capital invested

- Positive risk-adjusted performance measures

- Strategy alignment to the portfolio’s objective

- Favourable correlation with other strategies

- Proven track record and risk management capability

Data Collection and Due Diligence:

Our manager selection process seeks to identify and select unique CTA strategies, which outperform broader market returns by generating uncorrelated alpha trading. Using a disciplined and rigorous due diligence process coupled with on-going evaluation and analysis, the approved programs bring together an optimal mix of managers and strategies. Initially, managers are requested to submit their performance data with a list of key documentation. Subsequently, using this data we build the foundation of our analytical assessment. This evaluation of the signal strategies determines the necessity for a full quantitative and qualitative due diligence. Interviews are then arranged with the managers to validate the initial data from the research.