CTA Strategy Signals

Allocating to a CTA strategy signal provides a number of key benefits over equity and fixed income market returns. This includes the fact that amongst other benefits they are a great source of uncorrelated returns. Consequently, as a diversification tool simply investing in a premium CTA strategy contributes significantly towards portfolio protection.

We provide a number of trading signals for clients to select and execute, ranging from our flagship currency single-strategy product to a multi-strategy program that tracks four different trading styles. In addition our investment services extends to a fully systematic signals which applies our own trend following principles and philosophies to the financial markets.

Further to these trading signal our CTA advisory services offer clients the possibility of creating an investment product that is tailored to their financial needs. This includes; strategy evaluation, portfolio construction, currency hedging and brokerage advisory service.

Investment Philosophy

Gaining Market Alpha:

- Specialist strategies offer greater differentiation

- Manager skill generates excess returns

- Robust risk controls govern all strategy signals

- Judgement is the key advantage over broad analysis

- Disciplined approach will benefit portfolio returns

Over the years we have developed our core investment philosophy in order to created a number of successful CTA strategy signals. In our view, a thorough understanding of selected trading strategies provides greater returns over a holistic view on the market in general. Our investment philosophy lays on the fundamental principle that manager skill generates excess returns. Additionally, it is through the implementation of robust risk controls that protects the returns against adverse market conditions.

In our opinion, the expertise needed to analyse and interpret market data is learned over years of experience. It requires knowledge and sound judgement to create a hypothesis of market behaviour. In conclusion it is this judgement gives a key advantage over a broad analysis of the markets using only charts. By following a disciplined approach to trade generation ideas adhering to a strict risk management process, adds benefits from enhanced strategy returns over time.

Methodology for each CTA Strategy

- Technical

- Fundamental

- Behavioural

- Discretionary

Defining the different trading styles available within active CTA strategy management, requires a keen observation of the unique aspects of the strategy internal processes.

Empirical evidence from research into CTA investing has concluded that utilising a multi-strategy investment approach improves the return profile of traditional portfolios through strategy diversification. Allocating to a selection of CTA strategies that exhibit uncorrelated returns to the broader market improves performance opportunities, whilst simultaneously diversifying risk across a range of trading strategies. Choosing programs across a spectrum aids in blending together unique investment styles that are inherent to specific programs

In an interview with the Financial Times, Mikkel Thorup discusses the case for the discretionary element in CTA investing when selecting a CTA strategy. The full article on ‘A true CTA will stick to a chosen path’ is available on the www.ft.com website.

CTA Strategy Allocation

By allocating to several different strategies and not simply hunting returns, any portfolio will benefit from diversification and reduced volatility. This is the principle behind our investment philosophy when generating uncorrelated returns over the long term. Our goal is to achieve a diversification of various trading styles and time horizons across all traded markets. Furthermore, there are a number of predetermined risk controls used to safe-guard against potential drawdowns. This also includes governing the use of leverage by each signal strategy.

There are a number of benefits and controls that the portfolio signal generation process must adhere to, for example;

- Each strategy is actively managed on a day-to-day basis

- A blend of uncorrelated strategies reduces portfolio volatility

- Strategy allocation adjusted to suit the changing economic outlook

- Notional funding investors can adjust the risk/reward profile

- Lower administration costs than managing several signals

Benefits from Systematic CTA Strategy Approaches

Systematic trading strategies commonly use algorithms to complete a clearly defined task. To summarise, strategy signals use these algorithms to execute these tasks as efficiently as possible. As a result, the signal generation process benefits from the use of technology to identify specific trading opportunities. By creating predictive models based upon pre-determined indicators, these trading opportunities are easier to source and identify. Consequently, we can program systematic formulations to best match different trading strategies and the users’ risk appetite.

Systematic CTA Strategy Facts:

- Possibility of best rate executions depending upon liquidity

- Instant executions helps avoid significant price fluctuations

- Reduced risk of manual errors in placing the trades

- Backtesting possibilities based on historical and real time data

- Human errors based on emotional factors are reduced

The trading signals used to calculate and predict market opportunities come in many forms. These algorithms range from being a simple analytical indicator to complex investment strategies. A systematic approach is then used to implement multiple trading signals. However, the benefits from their use is clear with trading never being easier to execute. Additionally, by using algorithms for execution the cost trading is lowered significantly.

Discretionary CTA Signals – Sound Judgement

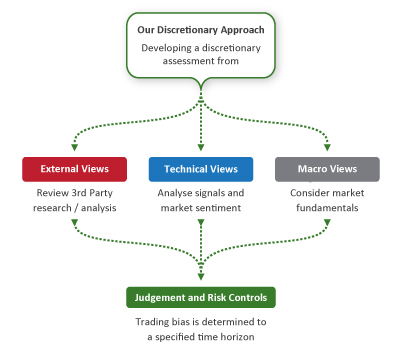

In our opinion the key to understand how the markets are functioning, firstly requires sound judgement from the manager before generating strategies. Secondly is the analysis and signals that based on technical or fundamental views. Thus, the discretionary assessment of a technical view is an important part of our trading process; it is where we have an edge and bring value.

During the investment process to search for the best trading signals, the investment team implements a discretionary assessment of the idea generation process with an evaluation of the macro views and external inputs. Hence, clients can benefit from our discretionary views as an overlay to a standalone CTA strategy. Alternatively, investors can benefit from our discretionary judgement to develop a tailored CTA strategy signal.